Accounts Receivable Management Software

Turn messy accounts receivable processes into seamless, automated workflows

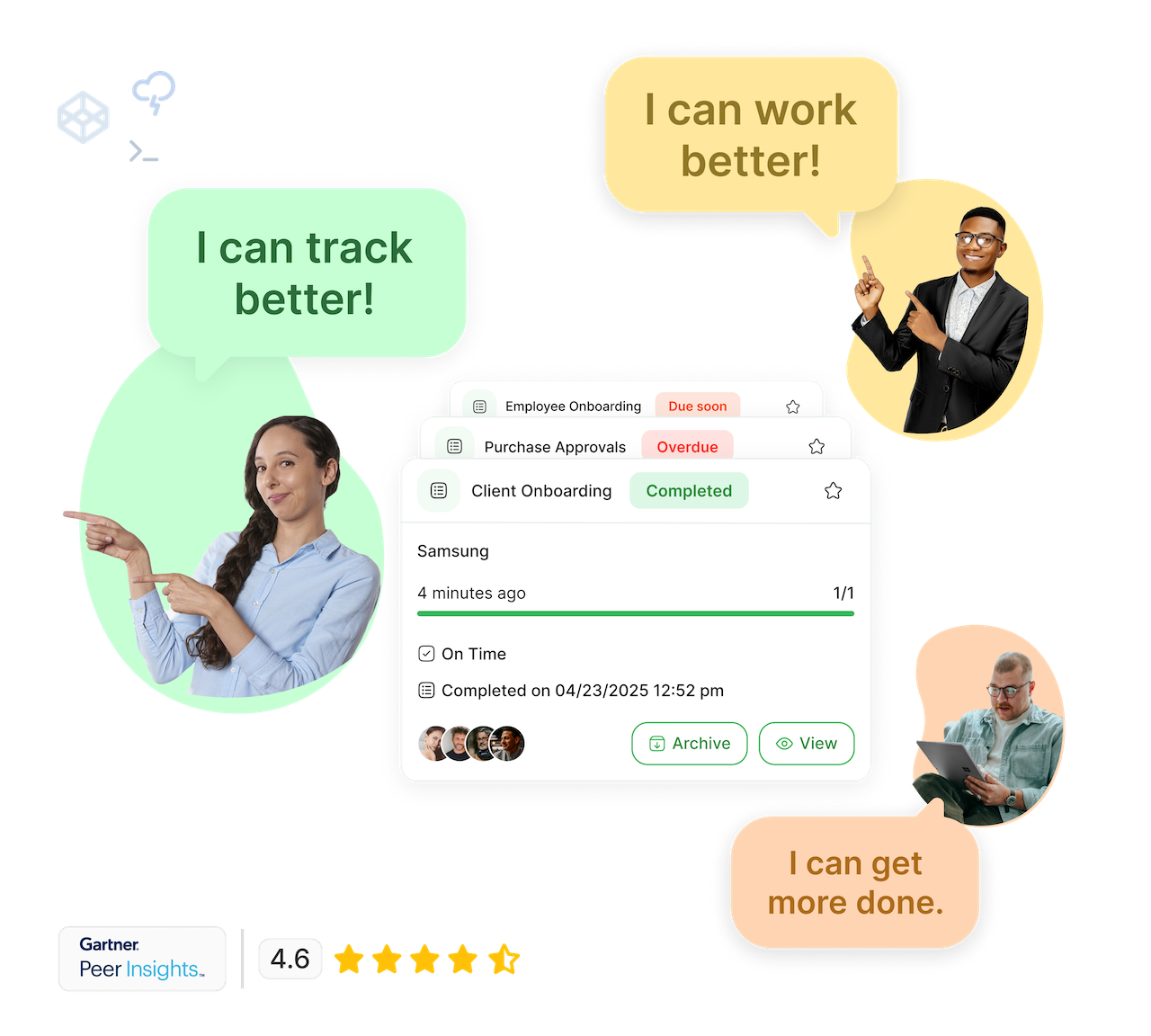

People ❤️ Tallyfy

Simple for everyone. Robust for champs.

"We can finally delegate work with confidence and focus on growing the business.

"A paper-based approval for critical purchases could take a couple of days before if someone was waiting for a director to be available for a signature. Now approvals are often completed in minutes.

"Tallyfy has been transformative for us. It's reduced manual errors, sped up processes like onboarding, and helped us document workflows that are critical as we grow. The ability to track tasks and aggregate them in one place saves us so much time and ensures that nothing falls through the cracks.

"Tallyfy is intuitive, fun and visually appealing. We can quickly gather every detail we need from our client in order to finish it on time. All the documents, specific details and comments are in one place.

"It has become a regular thing that people say 'put that in Tallyfy'. They know it by name. It has become the executive approval tool for our company. We have bi-weekly Tallyfy calls where we review what needs approval and what is pending - it keeps everyone aligned.

"It used to take us two days to run monthly client campaigns, now, with the help of Tallyfy, we complete them in just a few hours!

"Tallyfy is a very reliable way to delegate and track tasks with confidence. It has taken the guesswork out of the equation and has helped our team focus on delivering a service within deadlines. Thank you for making my life much easier!

"Our clients and team sail through the Tallyfy process - there is no need for clients to log in, there is one link for everything they need to do, everything saves in real-time - it all works incredibly well! I can't imagine scaling our agency without Tallyfy.

"Tallyfy has revolutionized how we manage our marketing projects at West Community Credit Union. It allows us to quickly launch tailored campaigns and track every moving part, ensuring nothing falls through the cracks. The ease of creating flexible, repeatable processes has saved us significant time and improved team collaboration.

"Tallyfy transformed how we manage client onboarding and policy renewals. It eliminated inefficiencies, reduced meeting times from hours to minutes, and helped us avoid costly penalties by automating key processes. We now have full visibility over tasks, and I no longer need to chase down updates - it's all right there.

"With Tallyfy, we have seen clarity in our processes as well as any bottlenecks. Tallyfy would be a good fit for any company that has a design, approval and implementation process that needs to have a quick turn around and that is growing fast.

"Tallyfy has helped our team streamline the efficiency of our processes. We now have smooth processes from beginning to end - without any steps being forgotten or skipped.

"If you want to be efficient and scale your business then Tallyfy is the way go. There is no question about it.

"Routing multiple documents is far quicker and there's immediate accountability and oversight. After switching to Tallyfy, routing documents and layouts went from taking over a week to taking just 2-3 days.

"We can finally delegate work with confidence and focus on growing the business.

"A paper-based approval for critical purchases could take a couple of days before if someone was waiting for a director to be available for a signature. Now approvals are often completed in minutes.

"Tallyfy has been transformative for us. It's reduced manual errors, sped up processes like onboarding, and helped us document workflows that are critical as we grow. The ability to track tasks and aggregate them in one place saves us so much time and ensures that nothing falls through the cracks.

"Tallyfy is intuitive, fun and visually appealing. We can quickly gather every detail we need from our client in order to finish it on time. All the documents, specific details and comments are in one place.

"It has become a regular thing that people say 'put that in Tallyfy'. They know it by name. It has become the executive approval tool for our company. We have bi-weekly Tallyfy calls where we review what needs approval and what is pending - it keeps everyone aligned.

"It used to take us two days to run monthly client campaigns, now, with the help of Tallyfy, we complete them in just a few hours!

"Tallyfy is a very reliable way to delegate and track tasks with confidence. It has taken the guesswork out of the equation and has helped our team focus on delivering a service within deadlines. Thank you for making my life much easier!

"Our clients and team sail through the Tallyfy process - there is no need for clients to log in, there is one link for everything they need to do, everything saves in real-time - it all works incredibly well! I can't imagine scaling our agency without Tallyfy.

"Tallyfy has revolutionized how we manage our marketing projects at West Community Credit Union. It allows us to quickly launch tailored campaigns and track every moving part, ensuring nothing falls through the cracks. The ease of creating flexible, repeatable processes has saved us significant time and improved team collaboration.

"Tallyfy transformed how we manage client onboarding and policy renewals. It eliminated inefficiencies, reduced meeting times from hours to minutes, and helped us avoid costly penalties by automating key processes. We now have full visibility over tasks, and I no longer need to chase down updates - it's all right there.

"With Tallyfy, we have seen clarity in our processes as well as any bottlenecks. Tallyfy would be a good fit for any company that has a design, approval and implementation process that needs to have a quick turn around and that is growing fast.

"Tallyfy has helped our team streamline the efficiency of our processes. We now have smooth processes from beginning to end - without any steps being forgotten or skipped.

"If you want to be efficient and scale your business then Tallyfy is the way go. There is no question about it.

"Routing multiple documents is far quicker and there's immediate accountability and oversight. After switching to Tallyfy, routing documents and layouts went from taking over a week to taking just 2-3 days.

Start by Tallyfying one recurring process

Perfect for digitizing procedures, from triggered workflows and approval chains you run manually today.

Tallyfy® is Accounts Receivable Made Easy

Stop chasing payments manually. Tallyfy automates your collection workflows so invoices get paid faster and your team spends less time on follow-ups. External parties can check their own payment status through guest links - no calls to your AR team needed.

How Tallyfy accelerates collections

From invoice sent to payment received in three steps

1. Document

Build collections workflows using templates like our client invoicing template with escalation rules based on days overdue.

2. Track

Monitor aging receivables with real-time visibility - customers get a permanent link to check their own payment status.

Is AR chaos acceptable?

Are you hearing this at work? That's busywork

Enter between 1 and 150,000

Enter between 0.5 and 40

Enter between $10 and $1,000

Based on $30/hr x 4 hrs/wk

Your loss and waste is:

every week

What you are losing

Cash burned on busywork

per week in wasted wages

What you could have gained

160 extra hours could create:

per week in real and compounding value

Total cumulative impact over time (real cost + missed opportunities)

You are bleeding cash, annoying every employee and killing dreams.

It's a no-brainer

Accounts receivable skills without the bills

Need help? We guarantee you can schedule free 25-minute screen-sharing calls with our workflow experts for life. We can help you integrate into your accounting tool and setup the workflow of your accounts receivable template.

SCHEDULE A CALL

Tallyfy is secure, proven and enterprise-grade

API & Webhooks

Free SSO

Middleware

BI & Data Export

Events & Triggers

AI & Automation

Security

Documents

Analytics & Metrics

Email Integration

Legal & Enterprise

Related Questions

What is accounts receivable management software?

It's software that tracks who owes you money and helps you actually collect it. Think of it as your collections assistant that never forgets a follow-up. In our conversations, we've heard teams describe their old process as "chaos with spreadsheets." Tallyfy turns that into automated workflows - reminders go out on time, nothing slips through the cracks, and payments come in faster.

What exactly is Tallyfy?

Tallyfy's a workflow platform that helps you stop losing track of things. You build a process once, then it runs the same way every time. Based on feedback we've received, users typically save about 2 hours per person per day. You can assign tasks to people or AI, track everything in real-time, and scale without the usual growing pains.

Why do businesses struggle with traditional accounts receivable processes?

Spreadsheets everywhere. Emails lost in inboxes. No one knows if a reminder was sent or not. We've heard this story dozens of times. Teams end up spending hours hunting for payment info, accidentally sending duplicate reminders, and wondering why cash flow looks terrible. It's not a people problem - it's a process problem.

How does Tallyfy change accounts receivable management?

You take your messy AR process and turn it into a structured workflow. Reminders go out automatically. You can see exactly where every invoice stands. Want to escalate accounts that are 60 days overdue? Set a rule once and forget about it. The system handles the grunt work so your team can focus on the exceptions that actually need human attention.

What makes Tallyfy different from traditional AR software?

Most AR software just tracks numbers. Tallyfy handles the actual work - who approves what, when reminders go out, how to negotiate payment plans. And you don't need IT to set it up or change anything. In discussions we've had, that's the part that surprises people most. They expect a steep learning curve that never shows up.

Can I see real customer reviews of Tallyfy?

Absolutely. We've got documented success stories from real businesses - not made-up testimonials. You can see actual implementation results and hear how other teams tackled their AR challenges with Tallyfy.

Does Tallyfy offer a free trial?

Yes. We'll set up a customized demo where you can actually test your AR processes - not some generic sandbox. Schedule a demo call and we'll get you started with a trial that makes sense for your specific situation.

How does Tallyfy pricing work for different countries?

Here's something different - we don't charge per user. Instead, pricing is based on your country's GDP per capita. That means businesses in emerging economies can get up to 90% off. It's lifetime pricing, not some introductory bait-and-switch.

Can Tallyfy handle complex AR workflows?

Yes. You can set up rules like "if payment is 30 days late, escalate to collections" or "if it's over $10,000, get additional approval before writing it off." These conditional branches handle complicated scenarios without you needing a computer science degree to configure them.

Does Tallyfy offer free help with AR implementation?

Yes - and this isn't a limited-time thing. We provide free help getting your workflows set up, improved, and running. Just schedule a call and our team will work through it with you. No extra charge, no upsell.

How does Tallyfy help with customer communication in AR?

Your customers don't need to create an account or remember a password. They get a secure link to view their invoice, approve a payment plan, or upload documents. That's it. In our experience, response rates go way up when you remove the friction of forcing people to log in.

How do financial services firms use Tallyfy for AR compliance?

Wealth management and financial services firms need audit trails for everything. Every reminder, every payment arrangement, every escalation - it's all recorded with timestamps that can't be changed. When SEC or FINRA comes knocking and asks "show me your collection practices," you've got documentation ready to go.

Can Tallyfy automatically escalate overdue accounts?

Yes. Set it up once: "30 days late? Goes to collections. Over $10,000 write-off? Needs extra approval." The system handles payment plan negotiations, dispute resolutions, credit holds - all without someone manually checking a spreadsheet every morning. Based on feedback we've received, this is what finally stops accounts from slipping through unnoticed.

Ready to streamline your operations?

Join thousands of teams using Tallyfy to eliminate inefficiency